Swiss Certified Tax Expert

Strategic advice, sustainable solutions, forward-looking in taxation

Modular, flexible, practice-oriented

Connected knowledge for complex challenges

Future skills for companies, individuals, and public authorities

Expert status with responsibility, diversity, and perspective

At a glance

Swiss Federal Diploma

«Dipl. Steuerexperte»

Next Intake

August 2026

Enrolment Deadline

July 2026

Blended Learning

Asynchronous e-learning combined with on-site or online teaching

Duration

2-4 years of part-time study

Teaching Days

Tuesday: 1.05 p.m. to 8.15 p.m. Saturday: 9.00 a.m. to 12.15 p.m.

Instruction

German

Teaching Location

EXPERTsuisse Campus in Zurich and online

Tuition Fees

from CHF 19,500 with member discount

Expertise with a lasting impact - Tax Expert Training

Tax advisory is about far more than just numbers and legal statutes. It demands the highest level of technical precision, strategic thinking, and strong communication skills. As a Swiss Certified Tax Expert, you operate at the intersection of law, business, and society—and you actively help to shape the landscape.

The Swiss Certified Tax Expert program from EXPERTsuisse is specifically designed to prepare you for this demanding role. In a modular course of study, you will acquire comprehensive competencies across all relevant areas of taxation—from VAT and corporate tax to complex international tax matters. This specialized knowledge is complemented by foundational business and legal principles, as well as practical case studies and real-world scenarios.

A Career with Outstanding Prospects:

The Swiss Federal Diploma opens up diverse career pathways—in consulting, within corporations, at government authorities, or in private practice. Swiss Certified Tax Experts are sought-after specialists for complex challenges and take on responsibility in key leadership roles.

Your Pathway to the Swiss Federal Diploma

Of course. This detailed text requires a translation that is not only accurate but also well-structured and professional. Here is a polished English version that reflects the quality of the program.

The Modular Program – Structured, Flexible, and Practice-Oriented

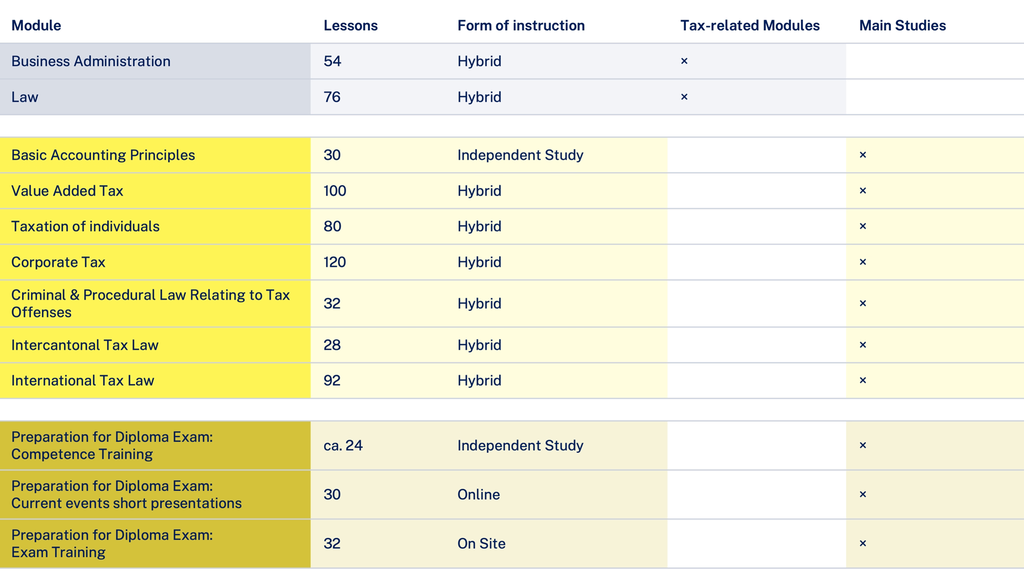

The program for the Swiss Certified Tax Expert diploma is modular, allowing for a personalized study plan that can be completed over 2 to 4 years. It is designed to be undertaken part-time, alongside your professional career.

The curriculum comprises a total of 698 lessons (45 minutes each), of which approximately 200 are delivered as asynchronous, self-paced e-learning modules.

Foundation Stage: Business Administration & Law

The program begins with two foundational modules covering the principles of business administration and law as they relate to taxation. These provide the essential framework for understanding the advanced tax modules that follow. The content is taught at a high level, always with a clear connection to practical tax issues.

Under the new examination ordinance, the Business & Law module exams must be passed at least two years before sitting for the final diploma examination.

Many candidates already possess a strong background in these areas from their prior degree. In such cases, it may be possible to receive an exemption (waiver) from one or both modules after consulting with the examination board. This may also lead to a partial refund of the tuition fees. Despite this option, we recommend attending the modules, as the content is specifically tailored to the requirements of the STEX program. Candidates without relevant prior knowledge should acquire these fundamentals through self-study before the program begins.

Core Studies: Specialized Tax Competency

The core of the program consists of seven specialized tax modules. The curriculum is comprehensive, covering topics from an introduction to the Swiss tax system, VAT, and individual taxation to corporate and international tax law. All content is practice-oriented and focuses on real-world professional scenarios.

Exam Preparation: Targeted and Up-to-Date

Three additional modules are designed to prepare you specifically for the final diploma examination:

Expert Competency Training

Examination Training

Current Topics in Taxation

This final stage serves to deepen and apply the knowledge you have acquired throughout the program.

Below are the recommended study pathways for the foundational «Business Administration & Law» modules and the Core Studies:

Flexible Entry Requirements: Admission is possible with a Master's, Bachelor's, or a relevant professional qualification.

Direct Program Start: No entrance assessments or prep courses are required. Waivers for the Business & Law modules are available for candidates with sufficient prior education.

Modular Structure: The 12 core modules can be scheduled flexibly over a period of 2 to 4 years.

Self-Paced E-Learning: Approximately 30% of the program's 700 lessons are delivered as asynchronous online modules, allowing you to study anytime, anywhere.

Hybrid Classroom: You choose how to attend live sessions—either virtually or in person on campus.

Admissions & Waivers

For information regarding admission requirements, as well as for waivers for the Business & Law modules, please consult the website of the official examining body for the Swiss Federal Examination for Tax Experts.

Module and Final Examinations

For information regarding the professional experience requirements and admission to the final exam, please consult the website of the official examining body for the Swiss Federal Examination for Tax Experts.

The training starts annually in August

- Self-paced e-learning (asynchronous instruction)

- Blended learning (a mix of asynchronous e-learning and synchronous classroom sessions on site or online)

- Registration deadline: End of July

Cost Overview

Notes

Includes all performance records for 3 certificate qualifications

VAT is charged on the course fees

Excluding module examination in Business Administration/Law

Excluding diploma examination

If you have been granted an exemption from the Business Administration and/or Law modules, the tuition fees are reduced accordingly.

Definitions

(Membership Regulations, 15.09.2020; Art. 2)

Individual members (specialist staff) are persons holding a Swiss Federal Certificate or a bachelor’s degree, thereby meeting the admission requirements for starting an expert training programme.

Corporate members are sole proprietorships, partnerships, legal entities and other independent public law organisations whose activities in auditing, tax consulting, business consulting/fiduciary services, or accounting/financial reporting are of substantial importance, and whose organisation and management provide assurance of the high quality of the services offered.

Federal Subsidies (subject financing)

Upon successful completion of your studies, you are entitled to government support covering 50% of the total training costs (excluding external examination fees), up to a maximum of CHF 10,500.

For the subsidies to be paid out by the State Secretariat for Education, Research and Innovation (SERI), the following statutory conditions must be met:

The invoice for the training must be issued to your private address, and your tax residence must be in Switzerland.

The full programme must be completed before taking the diploma examination – the subsidy is granted regardless of the examination result.

Further details on the application process can be found on the SERI website.

Module Coordinators

11 Members

Fabian Duss

Module-leading EFisc

Daniel Fankhauser

Module-leading EFisc

Matthias Gartenmann

Module-leading EFisc

Andrea Jost

Module-leading EFisc

Stefan Oesterhelt

Module-leading EFisc

Andrea Opel

Module-leading EFisc

Marco Passardi

Module-leading EFisc

Michael Wegmüller

Module-leading EFiscTake your career to the next level: Apply now for the Swiss Certified Tax Expert program.

Preparatory Modules for the module exams

Tax-related business administration and law modules 2026

Main study program

Information on the Industry Certificate

EXPERTsuisse is to introduce the new industry certificate "Tax Consultant EXPERTsuisse" on 1 January 2026 - with retroactive recognition for graduates of the STEX training programme. The Board of Directors took this forward-looking decision on 2 September 2025.

The new industry certificate of EXPERTsuisse highlights the exceptional features of the STEX training programme in terms of quality, scope and depth. It underlines the sustainable development of expertise in the tax sector and makes the high level of specialist knowledge, practical relevance and the commitment of graduates visible and well acknowledged - a strong signal to employers and the market.

A further milestone towards achieving the degree

The new industry certificate is a milestone and gateway to the federal examination of "certified tax expert". It is awarded under private law and directly by EXPERTsuisse AG - as a distinction for those who already operate at the highest level in the tax sector.Three certificate examinations - promising utmost quality

To obtain the industry certificate, one must successfully complete the three integrated certificate examinations in- value added tax (VAT)

- Taxes on natural persons

- Tax consulting for SME

Anyone who has not yet completed the tax certificates in full or with a sufficiently high grade can do so within five years. This makes it possible to obtain the industry certificate at a later date. There are partial waivers for the certificate examination for successfully completed module examinations of the sponsoring organization of the old diploma examination. Please consult the transitional provisions in the regulations on tax certificate audits.

The industry certificate is not an admission requirement to access federal examinations - but it provides strong evidence of the high level of professional expertise and ongoing development in the Swiss tax sector.

The industry certificate is awarded under private law and supplements the existing STEX training programme. The title of "certified tax expert" is presently still considered as the highest and most sought-after professional qualification in the Swiss tax sector. All possible confusion with the title of "tax consultant" must be strictly avoided.

The "Tax Advisor EXPERTsuisse" industry certificate offers true added value to students in a Swiss Certified Tax Expert course of studies – as visible proof of their professional and personal development.

The industry certificate

- attests to the professional tax sector expertise acquired during the Swiss Certified Tax Expert course of studies;

- confirms the student's broad, generalist expertise in all areas of the tax sector;

- uses a total of six partial tests to promote the continuous learning process and prepare students in a targeted manner for the federal final examinations;

- promotes not only continuous learning but also an in-depth examination of tax-related issues – thereby ensuring the long-term acquisition of skills;

- motivates by linking the programme’s successful conclusion with positive, emotionally formative experiences.

The industry certificate stands for measurable performance, personal development and joy in achievement.

Information for repeat participants

Even if the results of the diploma examination did not meet your expectations, we would like to encourage you to remain determined and continue following this path. An attempt not passed is not a failure – it is a vital step along your journey to success.

To ensure that you are as well-prepared as possible for your next examination, we offer our preparatory courses at special terms to repeat participants. Our goal is to provide you with the best-possible support and preparation to ensure that you can sit the next examination with even more self-assurance and expertise.

We firmly believe in your potential and consider it a pleasure to support you as you continue to pursue your diploma. Use this form to re-register for the individual modules

Online Information Events

Virtueller Informationsanlass, 05. März 2026, 12.00 – 12.45 Uhr

STEX-Ausbildung

Virtueller Informationsanlass, 09. April 2026, 12.00 – 12.45 Uhr

STEX-Ausbildung

Virtueller Informationsanlass, 07. Mai 2026, 12.00 – 12.45 Uhr

STEX-Ausbildung

Virtueller Informationsanlass, 04. Juni 2026, 12.00 – 12.45 Uhr

STEX-Ausbildung

Virtueller Informationsanlass, 02. Juli 2026, 12.00 – 12.45 Uhr

STEX-Ausbildung

Teaching Methods

Our program offers diverse teaching methods to help you develop professional expertise. A growing portion of the curriculum consists of self-paced learning modules that you can complete anytime, anywhere, providing maximum flexibility to fit your schedule. Important: This learning format requires strong self-motivation and discipline. You'll need to work through the asynchronous content independently to build the foundational knowledge essential for your professional development.

In addition to self-paced learning units, scheduled courses are also offered, either as in-person sessions on site or virtually via Zoom. These classes give you the opportunity to interact directly with lecturers, coaches, and fellow students. During the synchronous sessions, the foundations you have acquired are reinforced and applied in practice.

Each module is designed and guided by a team of experienced instructors and coaches with a strong practical focus. These recognised experts provide you with focused support in acquiring the competencies required for the demanding role of a Certified Tax Expert.

For each module, you will receive a structured study plan that serves as your roadmap, answering key questions to guide your learning:

What are the core topics and concepts?

How does this knowledge apply to real-world professional situations?

What are the key learning objectives for this module?

Which learning materials and resources are provided?

Your study plan is your personal guide throughout the program, providing a clear framework to help you organize and master your learning.

Professional Qualification

The Highest Qualification – NQF Level 8

The diploma as a Swiss Certified Tax Expert is classified by the State Secretariat for Education, Research and Innovation (SERI) at the highest level of the National Qualifications Framework (NQF), Level 8.

This classification confirms that the profession involves highly complex tax matters requiring advanced, specialised expertise. The three-year program of study, combined with four years of professional practice, provides the foundation for earning this nationally and internationally recognised title.

NQF Level 8 stands for the following competences:

Comprehensive, specialised knowledge across all areas of taxation

Ability to analyse complex tax issues systematically and place them in an interdisciplinary context

Development of legally sound and sustainable solutions within statutory frameworks

Application of tax expertise in both national and international settings

Contribution to the design of tax processes and structures in companies and organisations

Assumption of responsibility in demanding professional situations characterised by high technical and ethical complexity

Holding an NQF Level 8 diploma certifies a qualification at the very top of professional education in Switzerland—highly valued in practice and well recognised on the international labour market.

Three Certificates – One Strong Foundation

Certificate Courses and Qualifications – Verifiable Professional Expertise

As part of the Swiss Certified Tax Expert program, you will earn three recognized certificates that systematically document your specialized tax expertise. These certificate courses are an integral component of the main program but are also open to qualified external professionals.

Testimonials

1. How did you learn about the Swiss Certified Tax Expert program, and what sparked your interest?

My employer, PwC, sparked my interest in becoming a Swiss Certified Tax Expert, which was further confirmed by my own online research.

2. What positive experiences have you had in the program so far? Were there any special events, milestones, or people who have shaped your studies?

The most positive experience during my studies has been the practice-oriented approach to teaching. The instructors are highly competent, bringing both practical and theoretical expertise to the classroom, which makes the lessons lively and relevant. I found the International Tax Law module particularly valuable, as I could immediately apply the knowledge to my daily work—and conversely, my practical client projects helped me better understand the theory. This direct link between theory and practice has been the defining feature of my studies.

3. Which modules or courses did you find most valuable and why?

International Tax Law, Corporate Tax Law, and Taxation of Individuals.

4. What challenges have you encountered during the program, and what strategies helped you overcome them?

The biggest challenge for me was starting to study early enough for the exams, as the material is very comprehensive and I am working a 100% schedule. To overcome this, I relied on a systematic approach with a structured study plan and regular review sessions to solidify my knowledge.

5. How does the program specifically prepare you for your day-to-day professional life?

I am able to apply the various concepts from the modules directly to my professional tasks and contribute valuable input to my team.

6. What advice would you give to future students interested in the Swiss Certified Tax Expert program?

If you are serious about building a professional career in the field of taxation, you should absolutely consider this program.

7. Why would you recommend the Swiss Certified Tax Expert program to others?

The program provides first-class technical expertise for anyone who wants to build a successful career in taxation.

Of course. This is another excellent testimonial with a different perspective. Here is a professional English translation that captures the voice and detailed insights of the respondent.

1. How did you learn about the Swiss Certified Tax Expert program, and what sparked your interest?

It was somewhat by chance, actually. After completing my Master's in Law, I wasn't sure if I should sit for the bar exam. Once I decided against it, I began looking for an alternative. I knew I wanted to continue working with the law, but I also wanted to do something that satisfied my affinity for numbers. That's how I found my way to tax law and, consequently, to the Swiss Certified Tax Expert program.

2. What positive experiences have you had in the program so far? Were there any special events, milestones, or people who have shaped your studies?

Preparing for the certificate exams was very intensive, so it was all the more rewarding to pass them with excellent results. Beyond that, the program has truly confirmed that my decision to switch to the tax industry was the right one. My enthusiasm for the world of taxation remains as strong as ever.

3. Which modules or courses did you find most valuable and why?

I personally enjoyed the lectures on Corporate Tax Law the most. However, I believe the entire package is what’s most important, as it provides a comprehensive overview of all the relevant topics in tax law.

4. What challenges have you encountered during the program, and what strategies helped you overcome them?

The study period for the certificate exams has been one of my biggest challenges so far, mainly because these exams had never been conducted in this new format before, so it wasn't entirely predictable what to expect. Ultimately, what helped me most was creating a detailed study plan and sticking to it as closely as possible. At the same time, I made a point not to put my personal life completely on hold. In that regard, it was certainly helpful that I had consistently engaged with the lectures and completed the exercises from the very beginning.

5. How does the program specifically prepare you for your day-to-day professional life?

The program provides a very solid foundation of technical knowledge for my daily work, which allows me to make an initial assessment of a situation on my own. Additionally, there is a valuable exchange of real-world experiences during the classes (depending on the instructor), which in turn provides useful insights for my professional life. The various readings and presentation slides have also been incredibly helpful in allowing me to quickly find the right sources in my day-to-day work.

6. What advice would you give to future students interested in the Swiss Certified Tax Expert program?

The most important thing is to approach the program with curiosity and try not to lose that curiosity along the way. Tax law is a fascinating field that connects two seemingly independent disciplines (business and law). I also recommend staying on top of the material consistently throughout the program. What helped me most was completing the exercises before a lecture, so I would already know what I didn't understand. Going into a lecture unprepared isn't very effective, especially with a topic as complex as tax. The fact that the lectures are now recorded is a great help, as it allows you to prepare and work at your own individual pace.

7. Why would you recommend the Swiss Certified Tax Expert program to others?

The program is an essential foundation for a professional career in the tax industry. It gives you an overview of the most important topics—a breadth of knowledge that is very difficult to acquire on your own, as it’s easy to get lost in the sheer volume of literature and court rulings. Furthermore, it gives you an understanding of tax areas in which you may have little or no professional exposure. If you only learn "on the job," you tend to specialize quickly and may not develop knowledge of other critical areas of taxation.

1. How did you learn about the Swiss Certified Tax Expert program, and what sparked your interest?

As a Licensed Audit Expert (), I was already familiar with EXPERTsuisse before the program. After moving from a specialized role at a Big 4 firm to the more generalist fiduciary sector, I wanted to pursue advanced training specifically in taxation. As "the" definitive program in this field, the choice naturally fell on the Swiss Certified Tax Expert course.

2. What positive experiences have you had in the program so far? Were there any special events, milestones, or people who have shaped your studies?

The module exams were a defining part of the experience, as they provided a valuable benchmark of my progress throughout the program. Additionally, the diploma thesis was a significant milestone. It challenged me to analyze a complex issue in a structured way and develop a practice-oriented solution within a limited timeframe—a task that advanced my skills both technically and methodologically.

3. Which modules or courses did you find most valuable and why?

Most modules were taught by very high-caliber, specialized instructors, which made the exchange of ideas exceptionally valuable. I found the modules on International Tax Law and VAT to be particularly helpful, as these are, in my opinion, the areas currently undergoing the most significant developments.

4. What challenges have you encountered during the program, and what strategies helped you overcome them?

Balancing work and study is not always easy, especially given the busy season in the fiduciary industry. It was incredibly valuable that the lectures were recorded, allowing me the flexibility to catch up on any missed sessions.

5. How does the program specifically prepare you for your day-to-day professional life?

Client issues are becoming (or at least feel) increasingly complex. The program imparts practice-oriented expertise that can be applied directly to daily professional life. The broad scope of the curriculum is especially helpful: it covers various tax types, international matters, social security, and current developments in legislation and case law. This diversity enables the kind of holistic and targeted advice that is required every day in the fiduciary sector.

6. What advice would you give to future students interested in the Swiss Certified Tax Expert program?

Attend the classes in person whenever possible. The direct exchange with fellow students and instructors is extremely valuable.

7. Why would you recommend the Swiss Certified Tax Expert program to others?

The Swiss Certified Tax Expert program stands out for its strong practical focus, the high quality of its instructors, and its comprehensive coverage of relevant subject areas. For anyone who wants to provide well-founded, holistic, and up-to-date advice in the field of taxation, this program is a worthwhile investment in their professional future.

1. How does the Swiss Certified Tax Expert (STEX) program specifically prepare students for their day-to-day professional life?

The program not only imparts the fundamentals of everything from income tax and VAT to corporate taxation, but it also fosters the crucial ability to navigate ever-changing tax legislation. For students who aspire to a demanding and versatile career in taxation—whether in the corporate sector, public administration, or consulting—this program provides an excellent foundation.

2. Why would you recommend the Swiss Certified Tax Expert program?

As an Instructor of Tax Law and the Module Leader for Tax Criminal Law and Tax Procedure Law, I recommend the Swiss Certified Tax Expert program with full conviction. It offers students an outstanding opportunity to acquire comprehensive and in-depth knowledge in the vital and dynamic field of tax law. The qualification opens doors to fascinating responsibilities and offers excellent career opportunities in a professional field where demand is consistently high.

Downloads & Links

- Presentation information event (in German)pdf (1.77 MB)

- Application form for main studies starting in August 2026 (in German)pdf (225.26 KB)

- Registration for the tax-related modules Business Administration and Law 2026 (in German)pdf (183.68 KB)

- Registration for exam training for repeat students 2026 (in German)pdf (75.57 KB)

- Registration form for discussion of last year's module examinations in business administration/law for repeat students/external students (in German)pdf (44.13 KB)

- Learning path: Business Administration & Tax Lawpdf (179.21 KB)

- Main studies Value Added Taxpdf (297.75 KB)

- Main studies Corporate Taxpdf (290.33 KB)

- Bibliography Tax experts (in German)pdf (526.12 KB)

- Regulations governing tax certificate examinations (in German)pdf (156.99 KB)