Certificate course «Value Added Tax (VAT)»

- Practical know-how in national and international VAT law

- For professionals from companies, administrations and the fiduciary sector

- Consolidation of consulting skills and confident application in everyday working life

- Flexible learning format with recognized certificate

At a glance

Conclusion:

«Value added tax EXPERTsuisse» certificate

Next start

August 2026 (application deadline: July 2026)

Next examination date

2027 February

Teaching days

Tuesday: 13.05 - 20.15 Saturday: 9.00 - 12.15

Language of instruction

German

Teaching location

Online and face-to-face lessons in Zurich (optionally also via livestream)

Duration

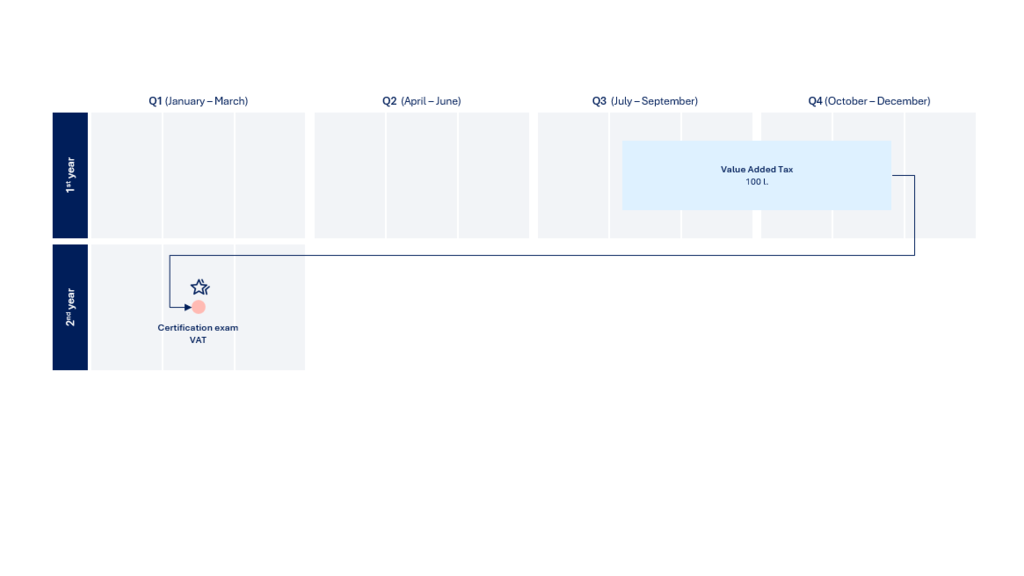

1 semester - part-time

Format

Blended learning - combination of online self-study, live webinars and classroom teaching

Course fees

from CHF 7,600 with member discount

Content

Basics and consolidation of value added tax

- General provisions

- Taxable person, tax liability, taxable object

- Tax rates, assessment basis, invoicing and tax statement

- Input tax deduction (general) and private shares, mixed use

- Changes in use, input tax correction and input tax reduction

- Time-based assessment

- Accounting methods and types

- Net tax rate method (incl. change of accounting method)

- Supply tax and import tax

- Origin and limitation of the tax claim

- Penalty provisions

- VAT settlements (declaration and corrections)

Sector-specific aspects of value added tax

- Real estate and land (sale and rental)

- Restructuring and application of the notification procedure

- Holding/participation companies and group taxation

- Commonwealth and flat tax rates [PSS]

- Air traffic, transportation (KTU + transportation) and travel agencies

- Risks, control (through FTA and internal ICS)

- Financial sector (trust, offshore, foundation + cryptocurrency) and insurance

- Sport, culture and healthcare as well as NPOs/NGOs

- Procedural law and statute of limitations

- Education and research and development (R&D)

- Platform taxation (by means of short presentations)

- Fundamentals of international value added tax

- Practical case studies

Detailed information

The course is aimed at professionals who wish to study VAT in depth - in particular employees of Big 4 companies and BDO AG, SME fiduciary companies, law firms, industrial, commercial and service companies as well as tax administrations.

Note:

The certificate course «Value Added Tax (VAT)» is an integral part of and is completed by students as part of their curriculum. Separate registration is not required for this target group.

Registration for the certificate course is possible if

- have basic business and legal knowledge

- you have a degree from a university or higher vocational training institution

- other qualifications are available

Registration for the certificate examination is possible if

- the lessons of the certificate course have been completed

- 1 year of professional experience in the field of taxation

Non-members:

CHF 9,500 (excl. VAT)

Expert and specialist employee individual members:

CHF 8,500 (excl. VAT)

Expert and specialist employee individual members from member companies:

CHF 7,600 (excl. VAT)