Certificate course «SME tax consulting»

- Practical know-how in SME tax issues: Corporate taxation, VAT, pensions

- For professionals from companies, administrations and the fiduciary sector

- Deepening of advisory skills and secure application in everyday professional life

- Flexible learning format with classroom and online elements

- Recognized certificate with specialist designation

At a glance

Conclusion:

Certificate «SME tax consultancy EXPERTsuisse»

Next start

August 2026 (application deadline: July 2026)

Next examination date

May 2028

Teaching days

Tuesday: 1.05 p.m. to 8.15 p.m. Saturday: 9.00 a.m. to 12.15 p.m.

Language of instruction

German

Teaching location

Online and face-to-face lessons in Zurich (optionally also via livestream)

Duration

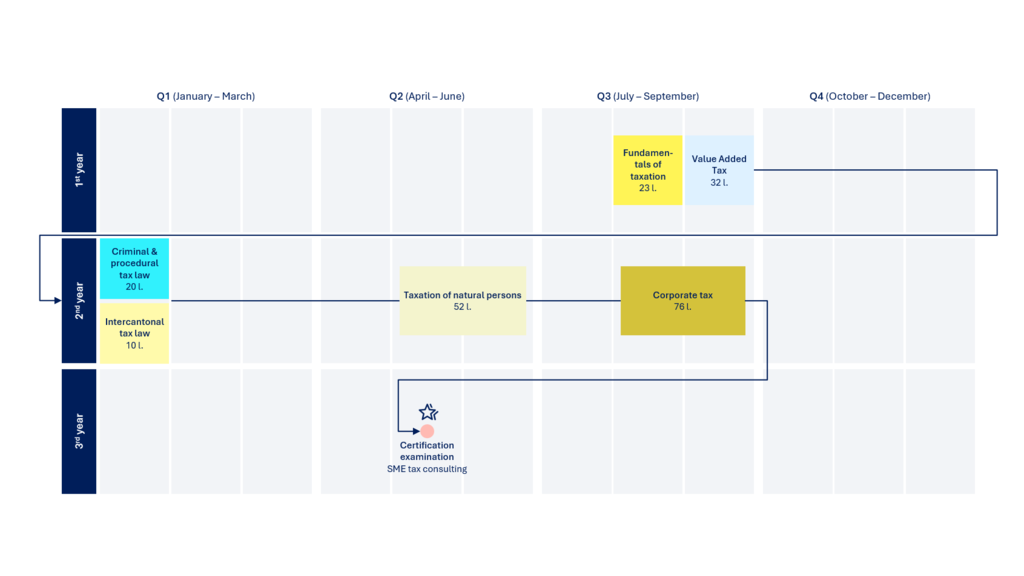

4 semesters - part-time

Format

Blended learning - combination of online self-study, live webinars and classroom teaching

Course fees

from CHF 14,400 with member discount

Content

Taxation of natural persons

- Taxation in general

- Tax liability

- Taxation according to expenditure

- Taxation of gainful employment

- Taxation of movable assets, bonds

- Property gains tax, property transfer tax, real estate tax

- Pension provision

- Determination of taxable income, general deductions, non-deductible costs and expenses, time-based assessment

- Wealth tax - valuation of unlisted companies

- Inheritance and gift taxes

- Corporate taxation

- Withholding tax and stamp duty

Basic features of value added tax

- General provisions

- Taxable person, tax liability, taxable object

- Tax rates, assessment basis, invoicing and tax statement

- Input tax deduction (general) and private shares, mixed use

- Changes in use, input tax correction and input tax reduction

- Temporal assessment

- Accounting method and type

- Reporting procedure

- Purchase tax and import tax

- Origin and limitation of the tax claim

- Procedural law and penalties

- VAT statements (declaration and corrections)

Corporate tax law

- Tax liability of legal entities

- Basics of corporate taxation

- Determination of profits

- Self-employment

- Withholding tax

- Participation deduction, loss offsetting, hidden equity

- Capital contribution principle and treasury shares

- Hidden benefits within the group

- Restructuring (partnerships, corporations)

- Reorganization

- M&A transactions

Procedural law

- Basic principles

- Tax procedural law

- Appeal, revision and supplementary tax proceedings

- Substantive criminal tax law

Intercantonal tax law

- Basic principles

- Basis for the tax separation of natural persons

Detailed information

The course is aimed at specialists in tax consulting and related areas - in particular employees of Big 4 companies and BDO AG, trust companies with a focus on SMEs, law firms, industrial and commercial enterprises and tax administrations who wish to deepen their tax consulting skills in the SME environment.

Note:

The certificate course «SME Tax Consulting» is an integral part of the training to become a certified tax expert and is completed by students as part of their curriculum. Separate registration is not required for this target group.

Registration for the certificate course is possible if

- have basic business and legal knowledge

- you have a degree from a university or higher vocational training institution

- other qualifications are available

Registration for the certificate examination is possible if

- the lessons of the certificate course have been completed

- 2 years of professional experience in the field of taxation

Non-members:

CHF 18’000 (excl. VAT)

Expert and specialist employee individual members:

CHF 16’200 (excl. VAT)

Expert and specialist employee individual members from member companies:

CHF 14’400 (excl. VAT)